Which Factor Explains the Variability of Investment

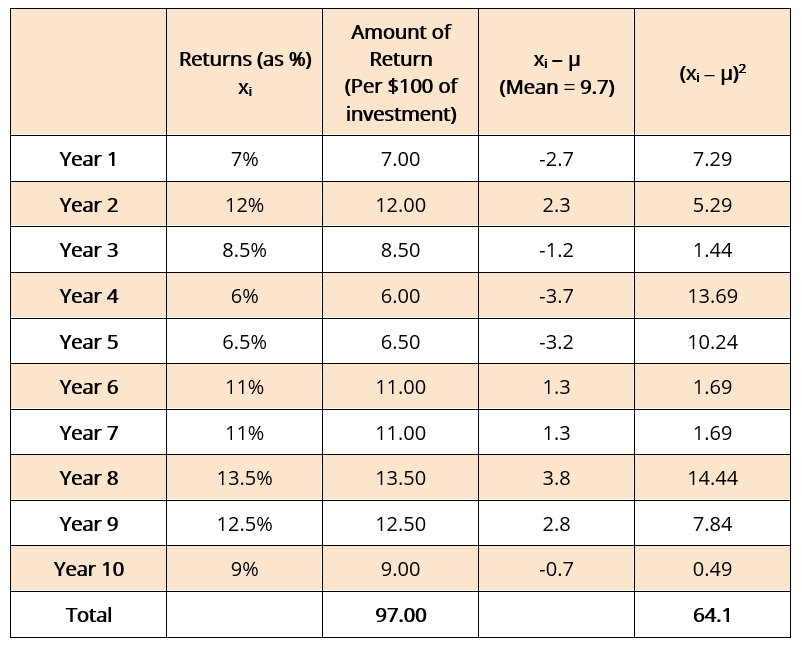

Up to 256 cash back Investment is usually referred to as the most unstable component of aggregate supply Several factors contribute to that instability. Variability is the extent to which data points in a statistical distribution or data set diverge from the average or mean value as well as the extent to.

Variability Overview Measures Use As A Risk Indicator

100 1 rating B.

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

. The expected return on the investment. The regularity of innovation. We currently identify six equity risk premia factors.

Fama and French propose a five-factor model that contains the market factor and factors related to size book-to-market equity ratio profitability and investment which outperforms the Fama-French Three-Factor Model in their paper in 2014. The durability of capital goods. In a private closed economy when aggregate expenditures equal GDP at equilibrium real.

Certain factors have historically earned a long-term risk premium and represent exposure to systematic sources of risk. Which factor explains the variability of investment. Which factor explains the variability of investment.

This is the best answer based on feedback and ratings. Which factor explains the variability of investment. The risk varies with the nature of investment.

It is a useful metric in finance when applied to measure the variability of investment returns. The level of investment in an economy tends to vary by a greater extent than other components of aggregate demand. Which factor explains the variability of investment.

The durability of capital goodsC. The constancy of profits. Characteristics of Investment Risk Factor.

Variability measures how much data points in any statistical distribution differ from each other as well as from their mean value. Irregularity of innovation 4. Risk refers to loss of principal amount delay or non-payment of capital or interest variability of return etc.

Explain how the variability of profits and expectations contribute to the instability of investment 8 marks. High variability in the returns is associated with a high degree of risk whereas low variability is associated with a relatively low degree of risk. Every investment differs in terms of risk associated with them.

The constancy of expectations D. Krugmans Economics for AP 2nd Edition David Anderson Margaret Ray. Expectations can be easily changed c.

And stock price volatility - among. Which factor explains the variability of investment. Irregularity of Innovation Technological progress is a major determinant of investment.

The durability of capital goods If disposable income is 350 billion and the average propensity to. Factor investing is the investment process that aims to harvest these risk premia through exposure to factors. The main determinants of investment are.

What factors explain the variability of investment. The constancy of expectations. These risks can include major policy changes.

The constancy of profits. It is good in the long run when matched with increased investment spending but bad during a recession because it reduces spending which further reduces output and employment. Investments in ownership securities like equity shares carry higher risk compared to investments in debt instrument like debentures bonds.

Innovation occurs irregularly d. Principles of Economics 8th Edition N. Investment is a sacrifice which involves taking risks.

The regularity of innovation. Profits very considerably 2. But as history shows major innovations such as the computer.

Variability of expectations 2. All of the choices are factors b. The durability of capital goods 98.

This is a summary of Factor Exposure Variation and Mutual Fund Performance by Manuel Ammann Sebastian Fischer and Florian Weigert published in the Fourth Quarter 2020 issue of the Financial Analysts Journal. Safety is another features which an investors desire for his investments. The durability of capital goods.

This is because the underlying determinants also have a tendency to change. Country-specific risk is the risk associated with the political and economic uncertainty of the foreign country in which an investment is made. This study investigates the performance of Fama-French Five-Factor Model and compare with that of Fama-French.

The regularity of innovation B. During the Great Recession of 2007-2009 the investment demand curve shifted. Risk is an inherent characteristic of every investment.

The safety of an investment implies the certainty of return of capital without loss of money or time. However less risky investments are the most preferred ones by. New products ond processes stimulate investment.

The variation in the level of investment by different investors is because of the regularity of. Value Low Size Low Volatility High Yield Quality and Momentum. Factors that have been identified by investors include.

Solved Which Factor Explains The Variability Of Investment Chegg Com

No comments for "Which Factor Explains the Variability of Investment"

Post a Comment